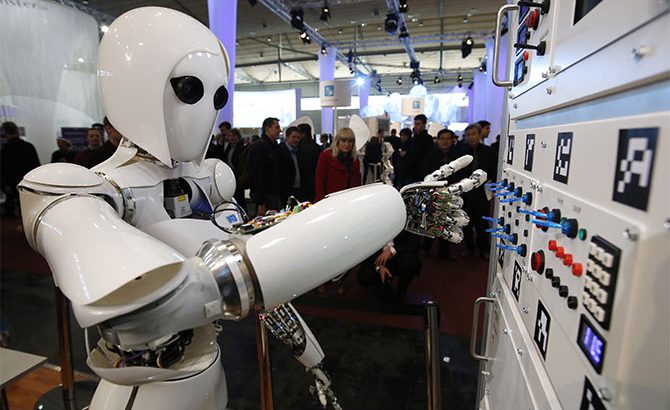

Artificial intelligence could destroy 120 million jobs worldwide within the next three years. It is the finding of a recent study conducted by IBM. Moreover, as a result of robotization – a theme that is more relevant than ever – millions of working people will have to retrain to reorient themselves towards new professions. At the same time, 41% of CEOs surveyed believe they do not have the financial resources to develop an AI strategy.

The study draws on the responses of 5,670 business leaders in 48 countries. It highlights complex challenges. Those require a fundamental change in the way companies respond to and manage changing labor needs at all levels of the organization. Thus, according to the results, the time required to fill a skills gap through training has increased more than 1000% in just four years. While in 2014, it took an average of three days to train an employee, in 2018, the duration of the apprenticeship would have reached 36 days; the report points out.

Despite this somewhat alarmist observation, the report provides a reassuring answer: while automation will certainly replace employees in many sectors, a job creation component will be created in parallel. New skills needs are expected to emerge quickly, while other profiles will become obsolete. And it is soft skills, i.e., knowledge, behavior and not technical skills, that will be the most sought-after.

Training plans still insufficient

Since 2016, professional profiles, mainly hardware and software developers, have been the most sought-after by companies, the report says. At present, it is behavioral knowledge that is preferred by recruiters, flexible, agile, adaptable, and able to manage priorities. For Amy Wright, associate director at IBM Talent & Transformation, with the arrival of AI, companies are increasingly facing the growing skills gap.

While leaders recognize the seriousness of the problem, half of those interviewed admit that they have no skills development strategy in place to address their most essential gaps, she says.

To this end, strategies are emerging to help them retrain their employees and create a culture of continuous learning necessary to successfully transition to AI. The main recommendation is to adopt a comprehensive approach to fill the skills gap through multimodal, personalized, and data-based development. To retrain, employees will have to follow training paths tailored to their current level of experience, skills, role, and career aspirations. To feed these paths, companies must take advantage of an ecosystem of partners to expand educational content, take advantage of learning technologies, and even share their strengths beyond their organizational boundaries.

Do you want to share your home address, email address, or phone number with advertisers and other third parties? Of course not. Since this information is personal and sharing, it could result in spam or worse. The same goes for your IP. Let’s review the reasons why you should hide IP or your IP address.

Do you want to share your home address, email address, or phone number with advertisers and other third parties? Of course not. Since this information is personal and sharing, it could result in spam or worse. The same goes for your IP. Let’s review the reasons why you should hide IP or your IP address.

First of all, will the banks, which have made so much effort to protect themselves against any eventuality, be put at risk by the newcomers?

First of all, will the banks, which have made so much effort to protect themselves against any eventuality, be put at risk by the newcomers?